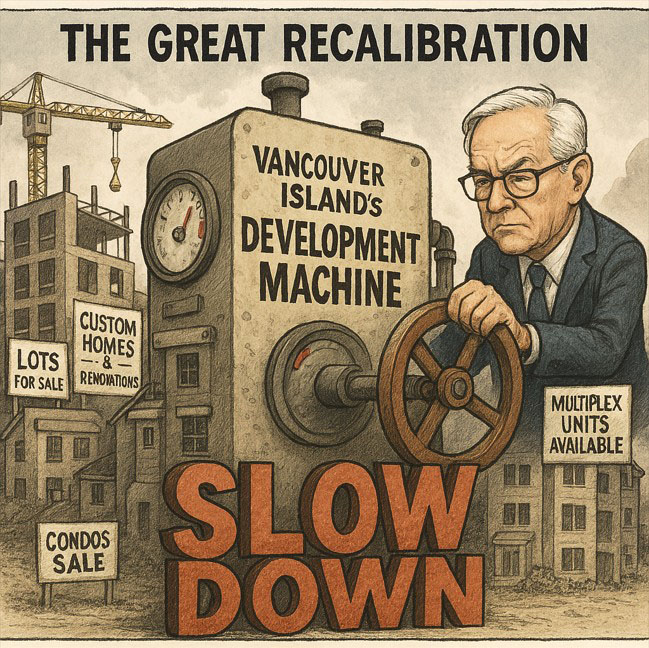

The Great Recalibration: Vancouver Island’s Development Machine Slows Down

M. Rose Munro

Feb 5, 2026

The Great Recalibration: Vancouver Island’s Development Machine Slows Down

Across Vancouver Island, the development and construction sector is showing unmistakable signs of transition. What once looked like an unstoppable boom is now revealing the contours of a market under financial, structural, and psychological pressure. The clues are scattered across leadership changes, advertising patterns, and shifts in how builders position themselves, but together they tell a clear story of an industry recalibrating after years of expansion fuelled by cheap credit.

The departure of the Urban Development Institute’s long‑serving leader is one of the clearest markers of this turn. For years, the region’s development narrative rested on confidence, expansion, and permissive zoning. Leadership change at this moment suggests that the old growth‑first playbook no longer matches the emerging conditions.

The marketplace is telling the same story. Social media feeds are now saturated with ads from major developers like Abstract, Reliance, FRAME, Aragon, promoting condos and multiplex units with incentives, discounts, and lifestyle‑based persuasion. Realtors are echoing the shift with messaging like “Downsize in Victoria – Lower costs, peaceful living.” These are not the slogans of a hot market. When demand softens, marketing pivots from inevitability to emotional reassurance.

Even more telling is the shift among developers who once sold finished homes but are now offloading bare lots. The same builders who marketed turnkey houses in Langford, Bear Mountain, or North Nanaimo are suddenly listing serviced lots instead – a striking move given that single‑family homes with land remain the most stable and sought‑after assets in the housing market. Selling land rather than completed builds is a classic defensive posture: it reduces risk, frees up cash, and transfers construction uncertainty to individual buyers. It signals tighter financing, rising carrying costs, and a growing reluctance among developers to bet on speculative inventory being absorbed quickly.

Local builders are adjusting too. Companies like LIDA Homes are advertising heavily for custom builds and renovation – another hallmark of a cooling cycle. When large projects slow, builders pivot to smaller, homeowner‑driven work because these projects are less sensitive to macroeconomic swings and don’t require the same capital outlay.

The labour market is shifting too. Trades and construction companies are advertising more aggressively, a reversal from the labour shortages that defined the past decade. When workers start chasing projects rather than the other way around, it reflects a thinning pipeline of new builds. The rise of construction‑management programs fits the same pattern: workers and institutions preparing for a future defined by infill, renovation‑scale work, and fewer large subdivisions.

All of this is unfolding against a provincial backdrop of fiscal strain. British Columbia’s finance minister Brenda Bailey recently described the situation as “serious times” requiring “difficult decisions.” When governments signal tightening, the development sector often feels it first, through financing conditions, consumer confidence, and shifting policy priorities.

Taken together, these signals point to a development landscape that is no longer accelerating but stabilizing, cooling, and reshaping itself. This is not a collapse but a transition. After years of rapid expansion, the Island’s development sector is adjusting to tighter financing, cautious buyers, and a political environment pushing toward smaller, denser, more incremental forms of housing. The industry is shedding some of its speculative exuberance and repositioning for a slower, more risk‑managed era.

Vancouver Island is now entering the early contours of a new development cycle, one defined not by speed, but by adaptation, consolidation, and a quieter, more deliberate form of growth.

—————————————————————————————————

See also:

Index of articles revealing major lobbying influence on B.C. Provincial Housing Bills and Housing Targets. – CRD Watch Homepage

Leave a comment